All Categories

Featured

Table of Contents

[/image][=video]

[/video]

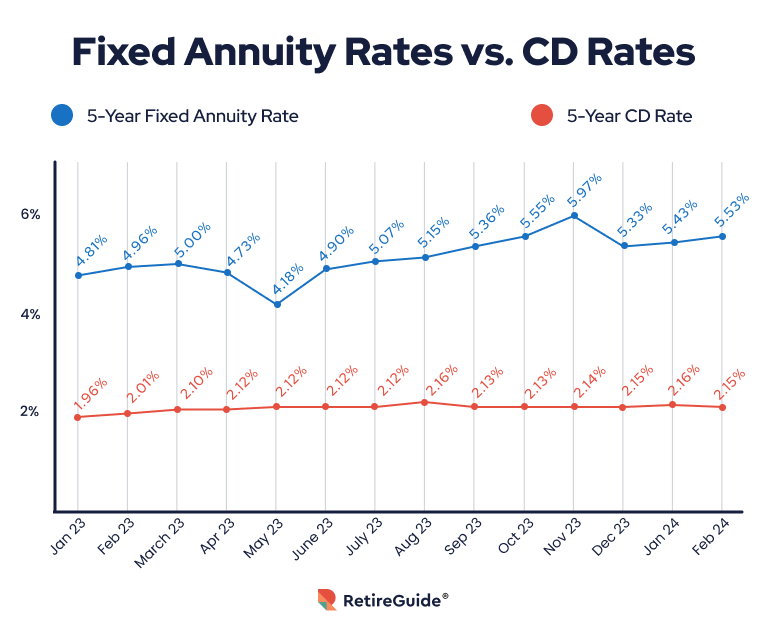

But the landscape is shifting. As rates of interest decline, fixed annuities may lose some charm, while items such as fixed-index annuities and RILAs gain traction. If you remain in the marketplace for an annuity in 2025, store meticulously, contrast options from the most effective annuity business and focus on simplicity and transparency to locate the appropriate suitable for you.

When picking an annuity, monetary stamina rankings matter, but they don't inform the entire story. Here's exactly how compare based upon their ratings: A.M. Best: A+ Fitch: A+ Standard & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Requirement & Poor's: A+ Comdex: A.M. Best: A+ Moody's: A1 Requirement & Poor's: A+ Comdex: A greater economic score or it just mirrors an insurance firm's financial strength.

A lower-rated insurance company might offer a, resulting in dramatically even more revenue over retirement. If you focus only on scores, you could The ideal annuity isn't almost company ratingsit's about. That's why comparing real annuity is a lot more essential than just checking out financial strength ratings. There's a lot of noise around when it comes to financial suggestions about annuities.

We have years of experience aiding people discover the right items for their demands. And since we're not connected with any kind of firm, we can provide you unbiased advice concerning which annuities or insurance policy plans are appropriate for you.

We'll help you arrange with all the choices and make the very best choice for your circumstance. When picking the very best annuity firms to recommend to our clients, we use a comprehensive technique that, then from there that consists of the complying with criteria:: AM Finest is a customized independent rating company that examines insurance provider.

And bear in mind,. When it pertains to repaired annuities, there are lots of alternatives out there. And with numerous selections, knowing which is best for you can be challenging. However there are some points to look for that can assist you limit the area. Go with a highly-rated firm with a solid track record.

Private Annuities Estate Planning

And ultimately, select an annuity that is understandable and has no gimmicks. By complying with these standards, you can be certain you're getting the best feasible deal on a repaired annuity.: Oceanview Annuity due to the fact that they often tend to have higher rate of interest prices with conventional liquidity. ("A" ranked annuity firm): Clear Springtime Annuity because they are uncomplicated, strong annuity prices and common liquidity.

Some SPIAs use emergency liquidity features that we like. If you seek a prompt income annuity, take into consideration set index annuities with an ensured life time revenue biker and start the revenue quickly. Annuity owners will have the adaptability to transform the retirement earnings on or off, accessibility their savings, and be able to stay on top of rising cost of living and gain rate of interest while getting the revenue for life.

The best-indexed annuities will offer the highest possible revenue and upside prospective while giving high protection for your financial savings. If you're looking for a choice to assist you maximize your retirement income, an indexed annuity might be the best choice.: North American's Income Pay Pro Annuity (A+ Ranked) and Nationwide's New Levels Deferred Income Annuity (A+ Ranked): North American's BenefitSolutions Annuity (A+ Ranked) and North American's BenefitSolutions Annuity (A+ Rated) are great deferred earnings annuities.

Athene Dexterity uses the income base with an enormous perk (20%) paid over a series of payments at fatality, and there's no added cost for this attribute. There are a few essential factors when looking for the ideal annuity. Compare interest prices. A higher rates of interest will offer even more development possibility for your investment.

This can instantly improve your financial investment, but it is important to recognize the terms attached to the perk prior to investing. Think about whether you desire a life time revenue stream. This kind of annuity can offer assurance in retired life, however it is vital to ensure that the earnings stream will certainly be sufficient to cover your needs.

These annuities pay a set monthly quantity for as lengthy as you live. And also if the annuity runs out of money, the regular monthly settlements will certainly continue originating from the insurer. That means you can rest very easy recognizing you'll constantly have a consistent revenue stream, regardless of for how long you live.

Annuity Bonus

While there are several various kinds of annuities, the finest annuity for long-term treatment costs is one that will pay for the majority of, if not all, of the costs. There are a few points to consider when choosing an annuity, such as the size of the agreement and the payout choices.

When selecting a fixed index annuity, compare the offered products to find one that finest matches your requirements. Delight in a lifetime revenue you and your spouse can not outlive, providing economic safety throughout retirement.

Annuity Lawyer Near Me

Furthermore, they permit approximately 10% of your account worth to be taken out without a charge on a lot of their product offerings, which is greater than what most other insurance policy firms allow. An additional consider our referral is that they will permit elders as much as and including age 85, which is likewise more than what a few other firms allow.

The best annuity for retired life will certainly depend upon your individual needs and purposes. Nevertheless, some functions are typical to all ideal retirement annuities. Firstly, a suitable annuity will certainly provide a steady stream of revenue that you can depend on in retirement. It needs to likewise use a risk-free financial investment alternative with potential development without threat.

Security Benefit Fixed Annuity Rates

Finally, an ideal annuity needs to likewise give a fatality advantage Your enjoyed ones are cared for if you pass away. Our recommendation is. They are and regularly supply some of the greatest payouts on their retirement revenue annuities. While rates rise and fall throughout the year, Fidelity and Assurance are typically near the top and maintain their retirement earnings competitive with the various other retired life revenue annuities in the market.

These scores give customers an idea of an insurance provider's monetary stability and just how most likely it is to pay out on claims. Nonetheless, it is necessary to note that these rankings don't necessarily mirror the high quality of the products provided by an insurance coverage business. An "A+"-ranked insurance firm might use products with little to no development potential or a reduced earnings for life.

Besides, your retirement cost savings are likely to be among one of the most crucial investments you will certainly ever before make. That's why we only recommend dealing with an. These firms have a tested record of success in their claims-paying ability and provide many features to help you meet your retirement objectives."B" rated firms should be stayed clear of at mostly all expenses. If the insurance company can't attain an A- or better score, you must not "bet" on its competence long-term. Surprisingly, numerous insurance coverage companies have actually been around for over half a century and still can not attain an A- A.M. Ideal score. Do you want to wager cash on them? If you're seeking life time revenue, stay with assured revenue riders and avoid performance-based income motorcyclists.

Latest Posts

Perspective Ii Fixed And Variable Annuity

Nationwide Monument Advisor Variable Annuity

Am Best Annuity Ratings